By now your exchange accounts should be setup, verified, and funded. If you haven't done that, please refer to Lesson 2. Now, if you've traded stocks before, this next part will be very familiar and intuitive because buying/selling crypto is much less complicated that equities. However, if this is your first time trading, you've come to the right place. Our goal is to make it plain.

Buying/Selling Basics

First, if you are familiar with trading stocks or other securities, then you can skip to the Sending/Receiving section. When buying/selling crypto, everything comes down to the chart, order book, and order type. The chart is a graph showing the historical price of the coin. For now we'll focus mainly on bitcoin (BTC) because it is the biggest and most liquid crypto market, but these basic principles pretty much apply to all coins.

Charts

This is a price chart, which you've probably seen before in regards to stocks or commodities.

The main information that you'll look for in the chart is historical price and trading volume information. You can zoom in and out over shorter or longer time frames to get a picture of the short term and long term trends. Now, there are a ton of other charting tools and people develop entire investment strategies around chart reading (aka Technical Analysis or TA), most of which are complete BS, and some of which are mostly BS with SOME usefulness. Anybody who claims to be consistently successful using TA exclusively to make trading decisions in the crypto market just hasn't been in it long enough yet or has been extremely lucky. Not to say that it's completely useless since enough people use it that it has become kind of like a self-fulfilling prophecy. If enough people see the same pattern and trade based off that perceived pattern, then the result they're expecting may actually come to pass because they've collectively willed it to happen. For example, if the chart shows a huge spike and the starts to show weakness, people may think a reversal is coming and the price may crash. If enough people believe that crash is coming, they will actually cause it to happen because that belief will affect their trading behavior. It's called market psychology.

There is, however, plenty of useful information about momentum, volume, and such that you can get from studying charts that will help you gauge market sentiment and notice trends. There are entire books and courses on the subject, but we won't cover it here. Our goal for now is just to get you up to speed so you can buy and sell.

Order Book

So while the chart shows you the historical prices (including the latest price), the order book will give you a better idea of the price you're actually more likely to pay. The order book shows you the liquidity available on that particular exchange, listing all the buy orders (bids) and sell orders (asks) for that particular trading pair (e.g. BTC/USD is the trading pair that shows the price of bitcoin in US Dollars). The difference between the highest bid and lowest ask is called the bid/ask spread. On smaller exchanges with low volumes, bid/ask spreads are usually significantly higher than large, high volume exchanges. Many traders make money "catching spreads," basically taking advantage of these price difference on one or several exchanges, which is called market making and is a form of arbitrage.

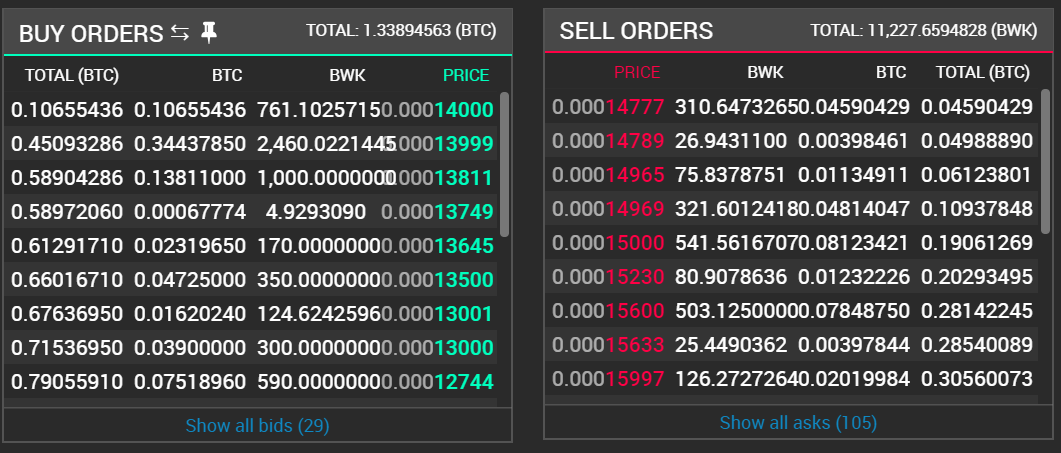

Here's an order book for the BWK/BTC trading pair, that is buying/selling bulwark in exchange for bitcoin:

From the above order book you can see the the highest price a buyer is will to pay in BTC for BWK and how many BWK they want to purchase by looking at the very first line, which shows a price of 0.0014 BTC/BWK on the far right column. As you work your way left, you see the amount of BWK they want to purchase (761.1025715), the amount of BTC it will take to purchase it (0.10655436), and finally, the far left column shows the cumulative amount of BTC in the order book up to that row. So on the first row, the first and second column from the left are the same, but you'll see that as you move down each row the left column increases, showing the sum of all the previous orders for the order represented in that row plus all the rows above it. Then at the very top right corner of the order book it shows the total of 1.338945 BTC, which is the number you would see on the last row of the left column, representing the BTC value of all the buy orders in that particular order book.

As you can see, the market for this order book isn't very deep, only at little more than 1 BTC. This means that a large seller who wanted to dump 1.4 BTC worth of BWK on this market would take up the entire supply and crash the price. This is the main reason why many crypto markets are so volatile. With relatively small amounts of money, you can cause great price swings because there isn't enough liquidity (buy or sell volume) to absorb the demand.

Keep this liquidity in mind when choosing an exchange to trade on and placing your orders. Unless you're actually trying to move the market, you'll need to be careful how much volume you put on there at one time, and this is a good time to talk about order types.

Basic Order Types

There are two basic order types, and some exchanges only give you the option of one of them: market orders or limit orders.

Market Orders

Market orders are filled at the best available price, which would be the lowest ask (sell) price if you're buying and the highest bid (buy) price if you're selling. So looking at the BTC/USD order book above. If you placed a market buy order for 1 BTC, you would pay a price of $6424.50 USD and your order would be fulfilled immediately. If you placed a market buy order of 2 BTC, the first 1.18 BTC will be filled at a price of $6424.50 and then the rest would be filled at a price of $6425.10, which is the second line on the right (sell/ask) side of the order book. The same goes for the bid/buy side if you're placing a sell order.

So, if you place a market buy order, you'll be filling the orders on the right side of the order book, which is the sell (ask) side. If you place a market sell order, then you'll be filling the order on the left side of the order book, which is the buy (bid) side.

Many exchanges also charge different fees for market orders vs limit orders. They usually want to encourage limit orders to beef up their orders books, so they'll charge slightly less, or even zero transaction fees. The reason being that limit orders provide liquidity to the exchange, and also there's a chance your order won't be filled quickly, or even at all, if you place a limit order because you have to wait for someone to accept that price and other more competitive prices might kick you further down the order book and get filled before your order. More liquidity on the exchange means more and larger trades can happen, so the exchange can handle more customers and trading activity, which means more profit for them.

Market orders take liquidity from the exchange, and this is where exchanges make their money, so the fees are higher. If you place a market order, presumably you need the coins right then, so you're more willing to pay extra for the faster speed of executing the trade. Many of the new, smaller crypto exchanges don't even offer market orders, so if you want your trade to go through immediately, you place a limit order at least matching the lowest price on the sell side or highest price on the buy side in order to take those offers immediately. The larger, consumer friendly/easy to use exchanges like coinbase and now square cash only deal in market orders, meaning they set the price and if you want coins, you pay it.

It is not usually a good idea to place a market order unless you can't wait to get your coins and want them right then, which is why a lot of crypto exchanges don't even offer the option.

Limit Order

With limit orders, you set the amount and price you're willing to accept and then wait for someone to accept that offer. This is called market making, as opposed to market orders, which are market taking. If you want to have the most competitive price, you would set it higher than the highest bid price if you wanted to buy, and lower than the lowest ask price if you wanted to sell. Again, looking at the order book above, if you wanted to buy BTC with a limit order and make sure your order gets filled before any of the other orders, then you would place a buy order with a price above $6422.40 and below $6424.50. For the best chance of having the order fulfilled soon while paying the fees associated with a limit order (liquidity maker) then you would place a buy order for $6424.49 or 1 cent less than the lowest ask order.

Be sure to check on your limit orders because there are a lot of trading robots out there that will outbid you immediately after you place your bid. You can usually tell when you're trading against a bot. It's best not to try and compete with them. Just place your bid for the same price or 1 cent less or else you'll cause a bidding war with a robot. Limit orders can go unfilled for a long time, especially if a breakout occurs and there's a big change in price over a relatively short period of time. Again, if you're in a hurry it's best to place a market order or a limit order at or slightly below the market price.

Here's a simple video showing the affect of market orders vs limit orders on an order book:

In summary. Buying/selling crypto is similar to buying/selling stocks and probably more simple in most cases because few crypto exchanges have advanced functionality. The main things you need to look at are the bid and ask prices in the order book, which is simply a list of all the prices and amounts that people are willing to buy/sell coins at for a particular trading pair, like BTC/USD which is the most common trading pair and represents the price of bitcoin in US dollars.

As always, if you're a BKS member, feel free to email us or hit us up on discord if you have questions about these concepts.