We partnered with HodlBot to help cryptocurrency investors manage risk. There are the two kinds:

-

Systematic risk — The inherent risk of participating in the cryptocurrency market.

-

Unsystematic risk — The risk an investor brings upon themselves when picking an individual coin/token.

Systematic market risk is inescapable. As with the saying, “a rising tide lifts all boats” and a falling tide sinks all boats. Conversely, unsystematic risk is a choice, as is the case when investors chase moonshots. This is not necessarily a bad thing, and you can make A LOT of money trying to pick big winners like this.

However, on average, most investors don’t benefit from taking on unsystematic risk. If the history of the stock market tells us anything, most investors are really bad at beating the market. Over the last 15-year period, 95% of active funds failed to beat index funds. The crypto market is not the same as the stock market, but it's still a good idea to have a least part of your portfolio tracking the market, so if your individual bets don't work out, you at least have a diversified crypto index that you believe will win in the long term.

That is to say, if you’re as confident in the crypto market as we are, then it is wiser to bet your money on the entire cryptocurrency market rather than test your luck picking individual coins.

"I know that the asset class will grow, but I don’t know who the winners will be."

Enter HODL 20

We’re giving non-accredited investors an easy and inexpensive way to bet on the cryptocurrency market as a whole without trusting your money to an investment manager/fund.

HodlBot plugs into your cryptocurrency exchange account and intelligently executes trades for you. IT IS NOT A FUND. They do not take a % fee, and clients own all of their own assets.

The first index attempts to capture the risk and return of the entire cryptocurrency market, and we’re calling it HODL 20. But you can also create your own portfolio!

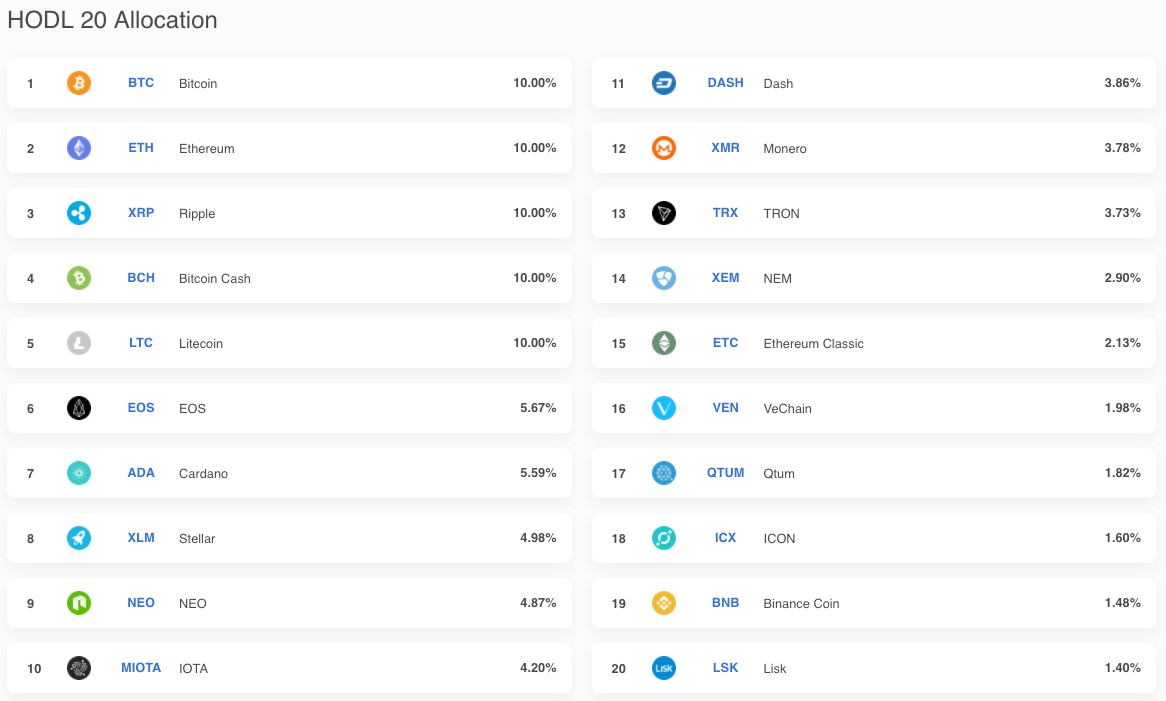

The HODL 20 Allocation

Since the market is quite young, not a ton of research has been done on cryptocurrency indices. A few projects have given it a shot: Crypto20, Cci30.

While each claims to “best” capture the market, we prefer not to make such boisterous claims.

Compared to the stock market, the cryptocurrency market has only been around for a short number of years. Claiming to have the very “best” index on such short-lived data is almost impossible, and entirely self-aggrandizing.

Truth be told, using any one of these methodologies to diversify is probably “good enough”.

Here’s the methodology they use.

We take the top 20 coins and assign each coin a % allocation based on their weighted market capitalization.

Then we cap every coin to be at most 10% of the total portfolio value. Anything above 10% gets redistributed to all the coins below by weighted market capitalization until the entire sum of the portfolio adds up to 100%.

Gist available here

HODL 20 Allocation as of March 25, 2018

Here is a quick measure of how effectively it captures the market:

The HODL 20 makes up ~87% of the cryptocurrency market. For comparison the S&P 500 represents ~75% of the US stock market.

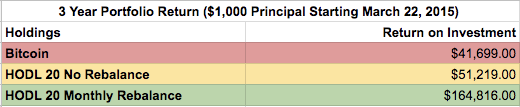

Over a 3 year period, Bitcoin was up by a factor of 42x. HODL 20 with no rebalancing was up a factor of 51x and the HODL 20 with monthly rebalancing was up a factor of 164x.

Rebalancing Periods

HodlBot rebalances your portfolio every 4 weeks to keep it consistent with the HODL 20 index.

They settled on 4 weeks as an appropriate rebalancing period, as longer periods do not track the market effectively while shorter periods incur higher transaction costs.

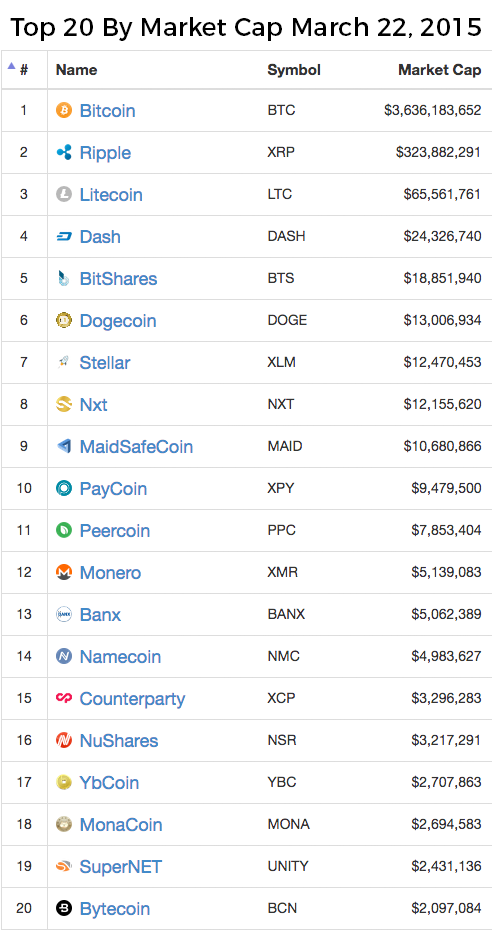

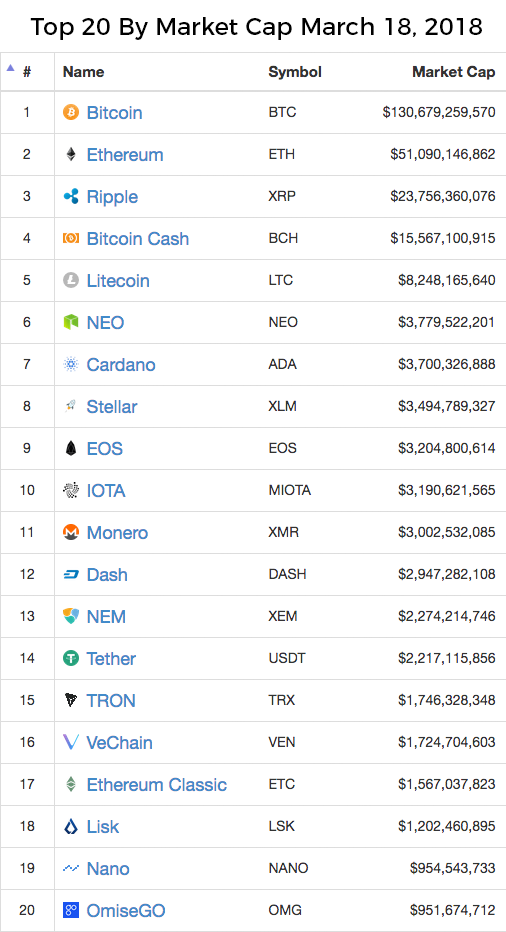

Historical snapshots from Coin Market Cap

As you can see, the top 20 has significantly changed over the years.

If you sign up, HodlBot will rebalance your portfolio immediately and then rebalance your portfolio again every 4 weeks. It’s pretty simple.

Any additional cryptocurrency that gets deposited in your account will be rebalanced at next rebalance date. You are free to dollar cost average into your account.

Transaction Fees from Rebalancing

We simulated the transaction fees from rebalancing the HODL 20 every 4 weeks for the last 3 years, assuming Binance’s 0.1% transaction fee to arrive at empirical average for annual transaction costs.

Average Annual Transaction Costs Simulated over 3 Year Period (March 22, 2015 — March 22, 2018)

This cost may be lower or higher depending on the volatility of the market in the future.

Subscription Fee

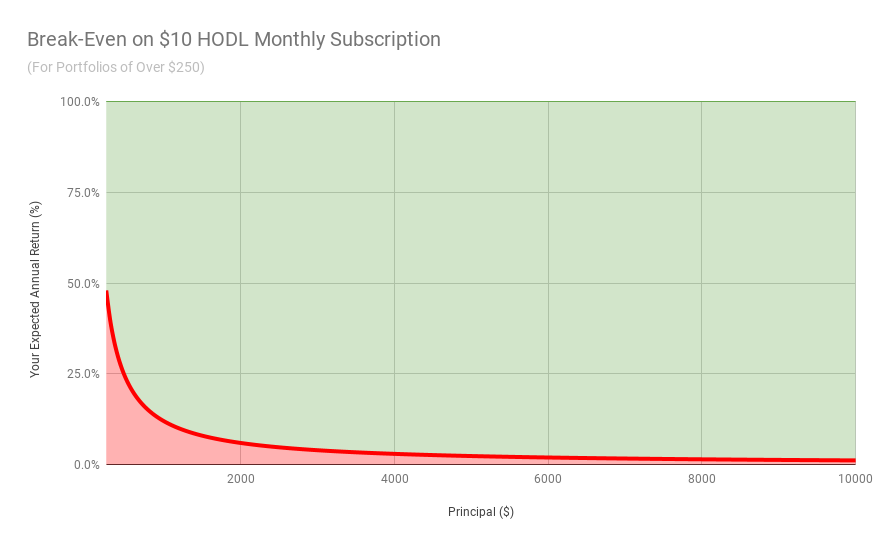

Because we are not a fund, we don’t charge a % fee. We charge a flat monthly fee for the service, no matter how much cryptocurrency you want to rebalance.

Although this scales really well with larger accounts, it is not so good for low minimum amounts.

We don’t want to screw over people with fees that are too high compared to their initial principal.So here’s some quick maths for what your minimum investment amount should be, given a range of expected returns.

If you have $100,000 you’ll need a much lower annual return % to breakeven than if you had $500.

The area in red shows a loss where subscription fees > returns. The area in green shows the combination of annual return & principal where < subscription fees.

Parting Words & Future Roadmap

The HODL 20 is a starting point for users who want to make a bet on the entire crypto market.

You can also create your own custom portfolios with the goal of democratizing algorithmic trading for everyday cryptocurrency investors.

Ultimately, we want to have as little of an opinion on what kind of portfolios are best. HodlBot is just here to do your dirty work, and make sure the same strategy is being executed every single day. Because cold unfeeling machines have the strongest hands.

No 3% annual fee on assets under management.

No bullshit sales propaganda on how we can actively beat the market.

We can’t tell you what’s going to happen in the market. Just because we almost 100x[‘ed] last year, doesn’t mean it will ever happen again. Think about it, and think about how you want to hedge your risk.