The Evolution of Money

original article by Vijay Boyapati posted here

There is an obsession in modern monetary economics with the medium of exchange role of money. In the 20th century, states have monopolized the issuance of money and continually undermined its use as a store of value, creating a false belief that money is primarily defined as medium of exchange. Many have criticized Bitcoin as being an unsuitable money because its price has been too volatile to be suitable as a medium of exchange. This puts the cart before the horse, however. Money has always evolved in stages, with the store of value role preceding the medium of exchange role. One of the fathers of marginalist economics, Stanley Jevons, explained that:

Historically speaking … gold seems to have served, firstly, as a commodity valuable for ornamental purposes; secondly, as stored wealth; thirdly, as a medium of exchange; and, lastly, as a measure of value.

Using modern terminology, money always evolves in the following four stages:

- Collectible. In the very first stage of its evolution, money will be demanded solely based on its peculiar properties, usually becoming a whimsy of its possessor. Shells, beads and gold were all collectibles before later transitioning to the more familiar roles of money.

- Store of value: Once it is demanded by enough people for its peculiarities, money will be recognized as a means of keeping and storing value over time. As a good becomes more widely recognized as a suitable store of value its purchasing power will rise as more people demand it for this purpose. The purchasing power of a store of value will eventually plateau when it is widely held and the influx of new people desiring it as a store of value dwindles.

- Medium of exchange: When money is fully established as a store of value its purchasing power will stabilize. Having stabilized in purchasing power, the opportunity cost of using money to complete trades will diminish to a level where it is suitable for use as a medium of exchange. In the earliest days of Bitcoin, many people did not appreciate the huge opportunity cost of using bitcoins as a medium of exchange, rather than as an incipient store of value. The famous story of a man trading 10,000 bitcoins (worth approximately $94 million at the time of this article’s writing) for two pizzas illustrates this confusion.

- Unit of account. When money is widely used as a medium of exchange goods will be priced in terms of it. I.e., the exchange ratio against money will be available for most goods. It is a common misconception that bitcoin prices are available for many goods today. For example, while a cup of coffee might be available for purchase using bitcoins, the price listed is not a true bitcoin price; rather it is the dollar price desired by the merchant translated into bitcoin terms at the current USD/BTC market exchange rate. If the price of bitcoin were to drop in dollar terms, the number of bitcoins requested by the merchant would increase commensurately. Only when merchants are willing to accept bitcoins for payment without regard to the bitcoin exchange rate against fiat currencies can we truly think of Bitcoin having become a unit of account.

Monetary goods that are not yet a unit of account may be thought of as being “partly monetized”. Today gold fills such a role, being a store of value but having been stripped of its medium of exchange and unit of account roles by government intervention. It is also possible that one good fills the medium of exchange role of money while another good fills the other roles. This is typically true in countries with dysfunctional states such as Argentina or Zimbabwe. In his book Digital Gold, Nathaniel Popper writes:

In America, the dollar seamlessly serves the three functions of money: providing a medium of exchange, a unit for measuring the cost of goods, and an asset where value can be stored. In Argentina, on the other hand, while the peso was used as a medium of exchange — for daily purchases — no one used it as a store of value. Keeping savings in the peso was equivalent to throwing away money. So people exchanged any pesos they wanted to save for dollars, which kept their value better than the peso. Because the peso was so volatile, people usually remembered prices in dollars, which provided a more reliable unit of measure over time.

Bitcoin is currently transitioning from the first stage of monetization to the second stage. It will likely be several years before Bitcoin transitions from being an incipient store of value to being a true medium of exchange and the path it takes to get there is still fraught with risk and uncertainty. It is striking to note that the same transition took many centuries for gold. No one alive has seen the real-time monetization of a good, as is taking place with Bitcoin, so there is precious little experience of the path this monetization will take.

Path dependence

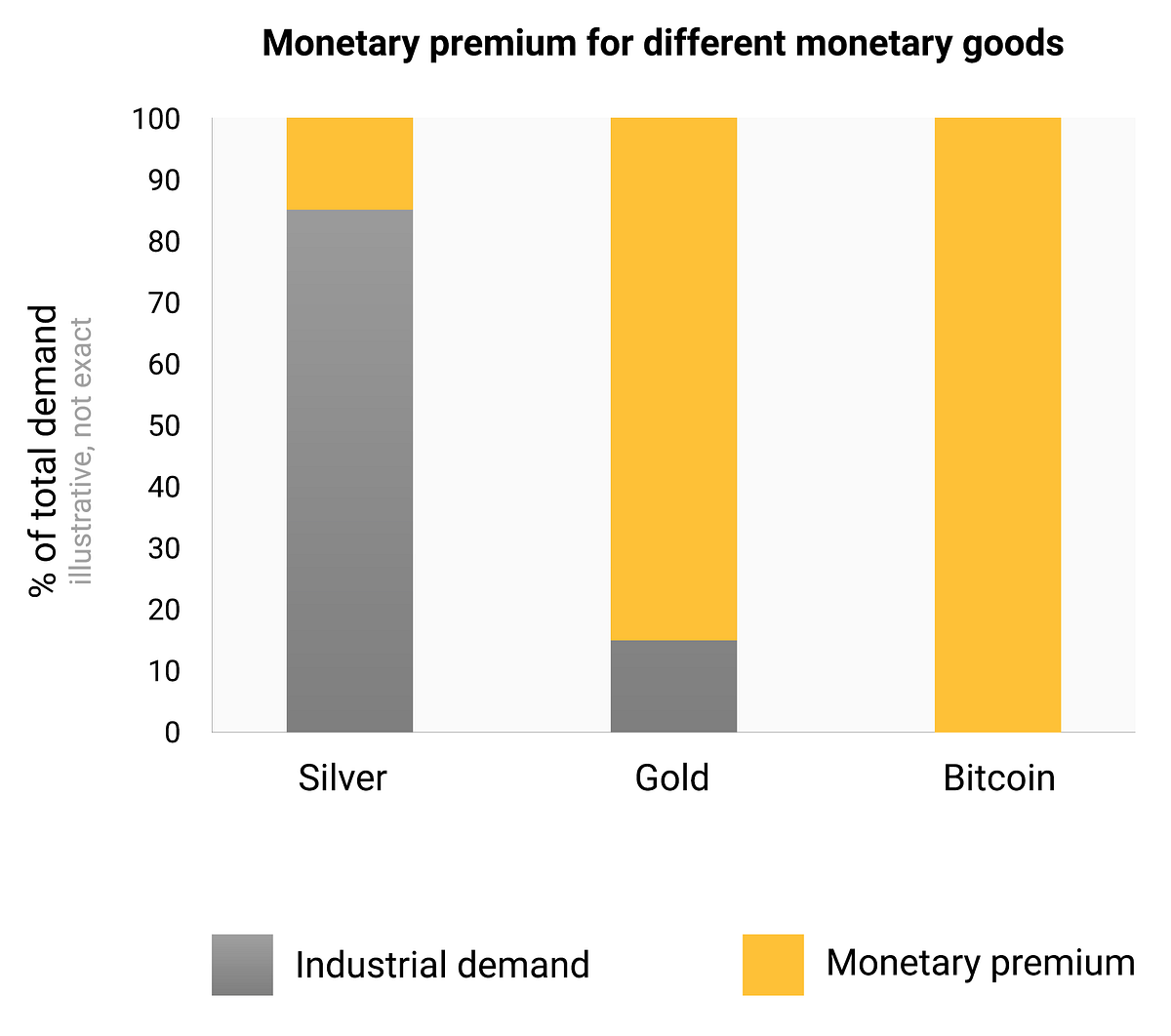

In the process of being monetized a monetary good will soar in purchasing power. Many have commented that the increase in purchasing power of Bitcoin creates the appearance of a “bubble”. While this term is often using disparagingly, to suggest that Bitcoin is grossly overvalued, it is unintentionally apt. A characteristic that is common to all monetary goods is that their purchasing power is higher than can be justified by their use value alone. Indeed, many historical monies had no use value at all. The difference between the purchasing power of a monetary good and the exchange value it could command for its inherent usefulness can be thought of as a “monetary premium”. As a monetary good transitions through the stages of monetization (listed in the section above) the monetary premium will increase. The premium does not, however, move in a straight, predictable line. A good X that was in the process of being monetized may be outcompeted by another Y that is more suitable as money and the monetary premium of X may drop or vanish entirely. The monetary premium of silver disappeared almost entirely in the late 19th century when governments across the world largely abandoned it as money in favor of gold.

Even in the absence of exogenous factors such as government intervention or competition from other monetary goods, the monetary premium for a new money will not follow a predictable path. Economist Larry White observed that:

the trouble with [the] bubble story, of course, is that is consistent with any price path, and thus gives no explanation for a particular price path

The process of monetization is game theoretic; every market participant attempts to anticipate the aggregate demand of other participants and thereby the future monetary premium. Because the monetary premium is unanchored to any inherent usefulness, market participants tend to default to past prices when determining whether a monetary good is cheap or expensive and whether to buy or sell it. The connection of current demand to past prices is known as “path dependence” and is perhaps the greatest source of confusion in understanding the price movements of monetary goods.

When the purchasing power of a monetary good increases with increasing adoption, market expectations of what constitutes “cheap” and “expensive” shift accordingly. Similarly, when the price of a monetary good crashes, expectations can switch to a general belief that prior prices were “irrational” or overly inflated. The path dependence of money is illustrated by the wordsof well known Wall Street fund manager, Josh Brown:

I bought [bitcoins] at like $2300 and had an immediate double on my hands. Then I started saying “I can’t buy more of it,” as it rose, even though that’s an anchored opinion based on nothing other than the price where I originally got it. Then, as it fell over the last week because of a Chinese crackdown on the exchanges, I started saying to myself, “Oh good, I hope it gets killed so I can buy more.”

The truth is that the notions of “cheap” and “expensive” are essentially meaningless in reference to monetary goods. The price of a monetary good is not a reflection of its cash flow or how useful it is but, rather, is a measure of how widely adopted is has become for the various roles of money.

Further complicating the path dependent nature of money is the fact that market participants do not merely act as dispassionate observers, trying to buy or sell in anticipation of future movements of the monetary premium, but also act as active evangelizers. Since there is no objectively correct monetary premium, proselytizing the superior attributes of a monetary good is more effective than for a regular goods, whose value is ultimately anchored to cash flow or use demand. The religious fervor of participants in the Bitcoin market can be observed in various online forums where owners actively promote the benefits of Bitcoin and the wealth that can be made by investing in it. In observing the Bitcoin market Leigh Drogen comments:

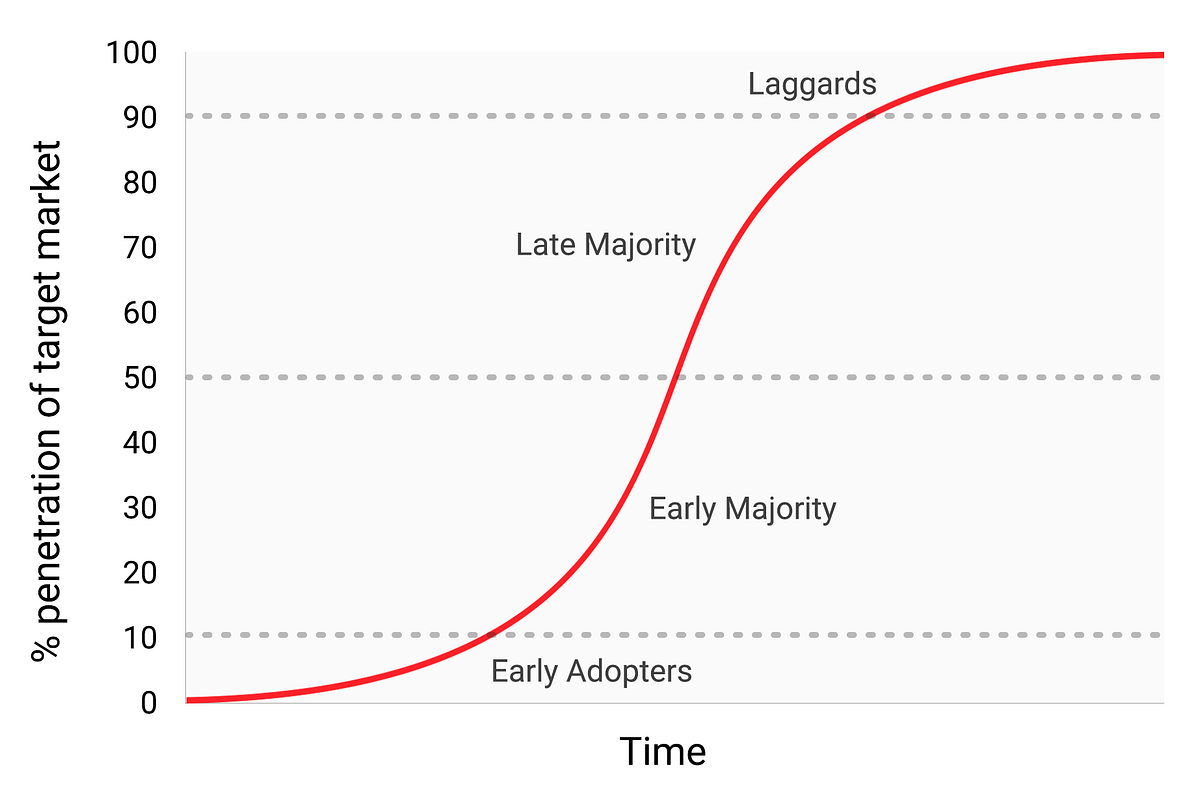

You recognize this as a religion — a story we all tell each other and agree upon. Religion is the adoption curve we ought to be thinking about. It’s almost perfect — as soon as someone gets in, they tell everyone and go out evangelizing. Then their friends get in and they start evangelizing.

While the comparison to religion may give Bitcoin an aura of irrational faith, it is entirely rational for the individual owner to evangelize for a superior monetary good and for society as a whole to standardize on it. Money acts as the foundation for all trade and savings, so the adoption of a superior form of money has tremendous multiplicative benefits to wealth creation for all members of a society.

The shape of monetization

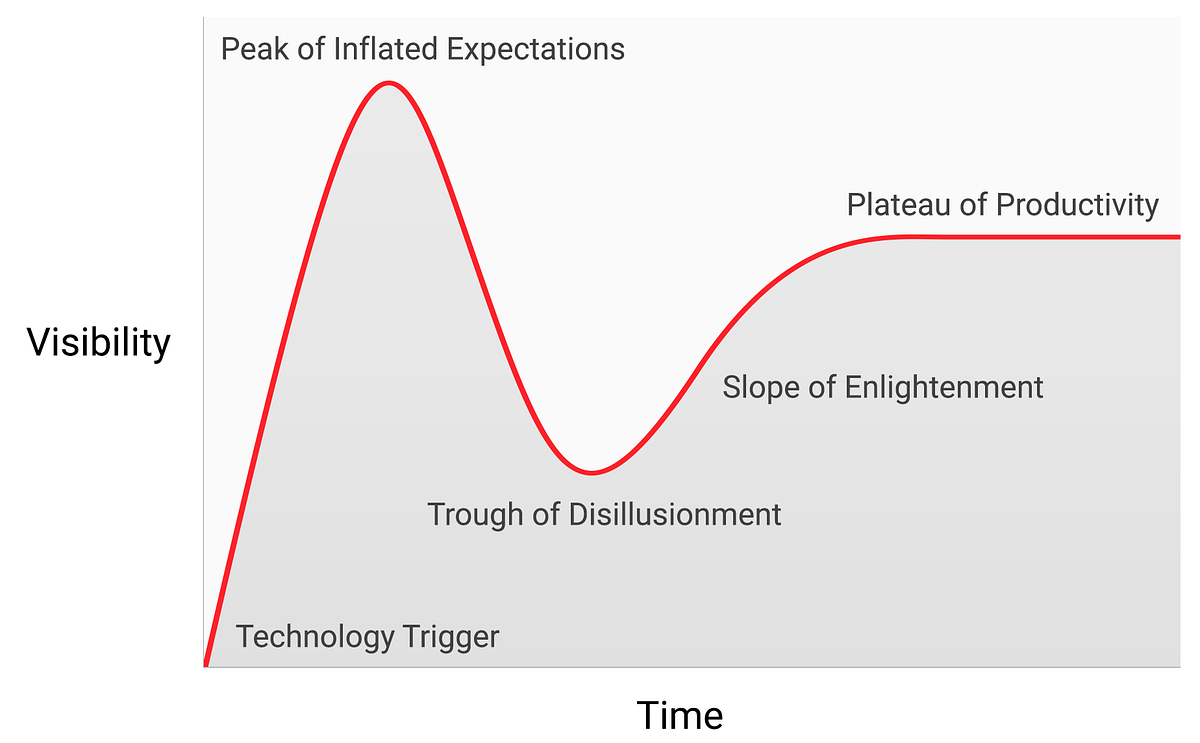

While there are no a priori rules about the path a monetary good will take as it is monetized, a curious pattern has emerged during the relatively brief history of Bitcoin’s monetization. Bitcoin’s price appears to follow a fractal pattern of increasing magnitude, where each iteration of the fractal matches the classic shape of a Gartner hype cycle.

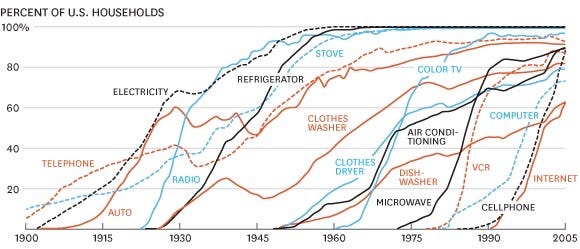

In his article on the Speculative Bitcoin Adoption/Price Theory, Michael Casey posits that the expanding Gartner hype cycles represent phases of a standard S-curve of adoption that was followed by many transformative technologies as they become commonly used in society.

Each Gartner hype cycle begins with a burst of enthusiasm for the new technology and the price is bid up by the market participants who are “reachable” in that iteration. The earliest buyers in a Gartner hype cycle typically have a strong conviction about the transformative nature of the technology they are investing in. Eventually the market reaches a crescendo of enthusiasm as the supply of new participants who can be reached in the cycle is exhausted and the buying becomes dominated by speculators more interested in quick profits than the underlying technology.

Following the peak of the hype cycle, prices rapidly drop and the speculative fervor is replaced by despair, public derision and a sense that the technology was not transformative at all. Eventually the price bottoms and forms a plateau where the original investors who had strong conviction are joined by a new cohort who were able to withstand the pain of the crash and who appreciated the importance of the technology.

The plateau persists for a prolonged period of time and forms, as Casey calls it, a “stable, boring low”. During the plateau, public interest in the technology will dwindle but it will continue to be developed and the collection of strong believers will slowly grow. A new base is then set for the next iteration of the hype cycle as external observers recognize the technology is not going away and that investing in it may not be as risky as it seemed during the crash phase of the cycle. The next iteration of the hype cycle will bring in a much larger set of adopters and be far greater in magnitude.

Very few people participating in an iteration of a Gartner hype cycle will correctly anticipate how high prices will go in that cycle. Prices usually reach levels that would seem absurd to most investors at the earliest stages of the cycle. When the cycle ends, a popular cause it typically attributed to the crash by the media. While the stated cause (such as an exchange failure) may be a precipitating event, it is not the fundamental reason for the cycle to end. Gartner hype cycles end because of an exhaustion of market participants reachable in the cycle.

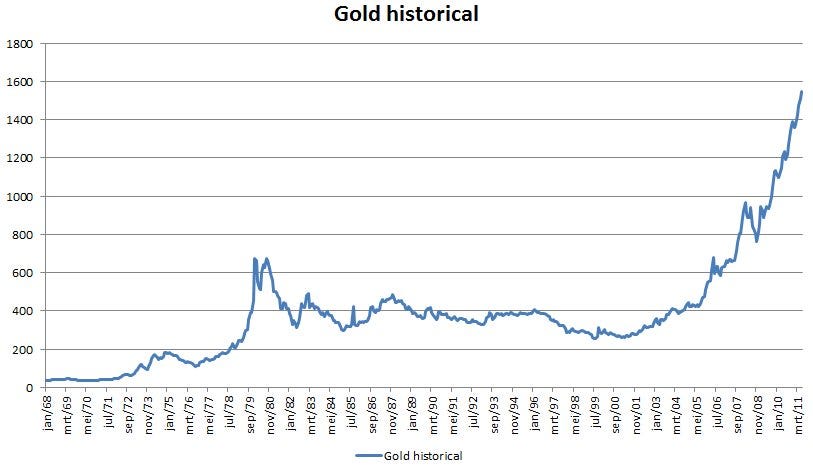

It is telling that gold followed the classic pattern of a Gartner hype cycle from the late 1970s to the early 2000s. One might speculate that the hype cycle is an inherent social dynamic to the process of monetization.

Gartner cohorts

Since the inception of the first exchange traded price in 2010, the Bitcoin market has witnessed four major Gartner hype cycles. With hindsight we can precisely identify the price ranges of previous hype cycles in the Bitcoin market. We can also qualitatively identify the cohort of investors that were associated with each iteration of prior cycles.

$0–$30 (2009–July 2011): The first hype cycle in the Bitcoin market was dominated by cryptographers, computer scientists and cypherpunks who were already primed to understand the importance of Satoshi Nakamoto’s groundbreaking invention and who were pioneers in establishing that the Bitcoin protocol was free of technical flaws.

$30–$250 (July 2011–April 2013): The second cycle attracted both early adopters of new technology and a steady stream of ideologically motivated investors who were dazzled by the potential of a stateless money. Libertarians such as Roger Ver were attracted to Bitcoin for the anti-establishment activities that would become possible if the nascent technology became widely adopted. Wences Casares, a brilliant and well-connected serial entrepreneur, was also part of the second Bitcoin hype cycle and is known to have evangelized Bitcoin to some of the most prominent technologists and investors in Silicon Valley.

$250–$1100 (April 2013–December 2013): The third hype cycle saw the entrance of early retail and institutional investors who were willing to brave the horrendously complicated and risky liquidity channels from which bitcoin could be bought. The primary source of liquidity in the market during this period was the Japan-based MtGox exchange that was run by the notoriously incompetent and malfeasant Mark Karpeles, who later saw prison time for his role in the collapse of the exchange.

It is worth observing that the rise in Bitcoin’s price during the aforementioned hype cycles was largely correlated with an increase in liquidity and the ease with which investors could purchase bitcoins. In the first hype cycle there were no exchanges available and acquisition of bitcoins was primarily through mining or by direct exchange with someone who had already mined bitcoins. In the second hype cycle, rudimentary exchanges became available but obtaining and securing bitcoins from these exchanges remained too complex for all but the most technologically savvy investors. Even in the third hype cycle, significant hurdles remained for investors transferring money to MtGox to acquire bitcoins. Banks were reluctant to deal with the exchange and third party vendors who facilitated transfers were often incompetent, criminal, or both. Further, many who did manage to transfer money to MtGox ultimately faced loss of funds when the exchange was hacked and later closed.

It was only after the collapse of the MtGox exchange and a two year lull in the market price of Bitcoin that mature and deep sources of liquidity were developed; examples include regulated exchanges such as GDAX and OTC brokers such as Cumberland mining. By the time the fourth hype cycle began in 2016 it was relatively easy for retail investors to buy bitcoin and secure them.

$1100–$19600? (2014–?):

At the time of writing, the Bitcoin market is undergoing its fourth major hype cycle. Participation in the current hype cycle has been dominated by what Michael Casey described as the “early majority” of retail and institutional investors.

As sources of liquidity have deepened and matured, major institutional investors now have the opportunity to participate through regulated futures markets. The availability of a regulated futures market paves the way for the creation of a Bitcoin ETF which will then usher in the “late majority” and “laggards” in subsequent hype cycles.

Although it is impossible to predict the exact magnitude of the current hype cycle, it would be reasonable to conjecture that the cycle reaches its zenith in the range of $20,000 to $50,000. Much higher than this range and Bitcoin would command a significant fraction of gold’s entire market capitalization (gold and Bitcoin would have equivalent market capitalizations at a bitcoin price of approximately $380,000 at the time of writing). A significant fraction of gold’s market capitalization comes from central bank demand and it’s unlikely that central banks or nation states will participate in this particular hype cycle.

The entrance of nation states

Bitcoin’s final Gartner hype cycle will begin when nation states start accumulating it as a part of their foreign currency reserves. The market capitalization of Bitcoin is currently too small for it to be considered a viable addition to reserves for most countries. However, as private sector interest increases and the capitalization of Bitcoin approaches 1 trillion dollars it will become liquid enough for most states to enter the market. The entrance of the first state to officially add bitcoins to their reserves will likely trigger a stampede for others to do so. The states that are the earliest in adopting Bitcoin would see the largest benefit to their balance sheets if Bitcoin ultimately became a global reserve currency. Unfortunately it will probably be the states with the strongest executive powers — dictatorships such as North Korea — that will move the fastest in accumulating bitcoins. The unwillingness to see such states improve their financial position and the inherently weak executive branches of the Western Democracies will cause them to dither and be laggards in accumulating bitcoins for their reserves.

There is a great irony that the US is currently one of the nations most open in its regulatory position toward Bitcoin, while China and Russia are the most hostile. The US risks the greatest downside to its geopolitical position if Bitcoin were to supplant the dollar as the world’s reserve currency. In the 1960s Charle de Gaulle criticized the “exorbitant privilege” the US enjoyed from the international monetary order it crafted with the Bretton Woods agreement of 1944. The Russian and Chinese governments have not yet awoken to the geo-strategic benefits of Bitcoin as a reserve currency and are currently preoccupied with the effects it may have on their internal markets. Like de Gaulle in the 1960s, who threatened to reestablish the classical gold standard in response to the US’s exorbitant privilege, the Chinese and Russians will, in time, come to see the benefits of a large reserve position in a non sovereign store of value. With the largest concentration of Bitcoin mining power residing in China, the Chinese state already has a distinct advantage in its potential to add bitcoins to its reserves.

The US prides itself as a nation of innovators with Silicon Valley being a crown jewel of the US economy. Thus far, Silicon Valley has largely dominated the conversation toward regulators on the position they should take vis-à-vis Bitcoin. However, the banking industry and the US Federal Reserve are finally having their first inkling of the existential threat Bitcoin poses to US monetary policy if it were to become a global reserve currency. The Wall Street Journal, known to be a mouth-piece for the Federal Reserve, published a commentary on the threat Bitcoin poses to US monetary policy:

There is another danger, perhaps even more serious from the point of view of the central banks and regulators: bitcoin might not crash. If the speculative fervor in the cryptocurrency is merely the precursor to it being widely used as an alternative to the dollar, it will threaten the central banks’ monopoly on money.

In the coming years there will be a great struggle between entrepreneurs and innovators in Silicon Valley, who will attempt to keep Bitcoin free of state control, and the banking industry and central banks who will do everything in their power to regulate Bitcoin to prevent their industry and money issuing powers from being disrupted.

The transition to a medium of exchange

A monetary good cannot transition to being a generally accepted medium of exchange (the standard economic definition of “money”) before it is widely valued, for the tautological reason that a good that is not valued will not be accepted in exchange. In the process of becoming widely valued, and hence a store of value, a monetary good will soar in purchasing power, creating an opportunity cost to relinquishing it for use in exchange. Only when the opportunity cost of relinquishing a store of value drops to a suitably low level can it transition to becoming a generally accepted medium of exchange.

More precisely, a monetary good will only be suitable as a medium of exchange when the sum of the opportunity cost and the transactional cost of using it in exchange drops below the cost of completing a trade without it.

In a barter based society, the transition of a store of value to a medium of exchange can occur even when the monetary good is increasing in purchasing power because the transactional costs of barter trade are extremely high. In a developed economy, where transactional costs are low, it is possible for a nascent and rapidly appreciating store of value, such as Bitcoin, to be used as a medium of exchange, albeit in a very limited scope. An example is the illicit drug market where buyers are willing to sacrifice the opportunity of holding bitcoins to minimize the substantial risk of purchasing the drugs using fiat currency.

There are, however, major institutional barriers to a nascent store of value becoming a generally accepted medium of exchange in a developed society. States use taxation as a powerful means to protect their sovereign money from being displaced by competing monetary goods. Not only does a sovereign money enjoy the advantage of a constant source of demand, by way of taxes being remittable only in it, but competing monetary goods are taxed whenever they are exchanged at an appreciated value. This latter kind of taxation creates significant friction to using a store of value as a medium of exchange.

The handicapping of market based monetary goods is not an insurmountable barrier to their adoption as a generally accepted medium of exchange, however. If faith is lost in a sovereign money its value can collapse in a process known as hyperinflation. When a sovereign money hyperinflates, its value will first collapse against the most liquid goods in the society, such as gold or a foreign money like the US dollar, if they are available. When no liquid goods are available or their supply is limited, a hyperinflating money will collapse against real goods such as real-estate and commodities. The archetypal image of a hyperinflation is a grocery store emptied of all its produce as consumers flee the rapidly diminishing value of their nation’s money.

Eventually, when faith is completely lost during a hyperinflation, a sovereign money will no longer be accepted by anyone and the society will devolve to barter or the monetary unit will have been completely replaced as a medium of exchange by another. An example of this process was the replacement of the Zimbabwe dollar with the US dollar. The replacement of a sovereign money with a foreign one is made more difficult by the scarcity of the foreign money and the absence of foreign banking institutions to provide liquidity.

The ability to easily transmit bitcoins across borders and absence of a need for a banking system makes Bitcoin an ideal monetary good to acquire for those afflicted by hyperinflation. In the coming years, as fiat monies continue to follow their historical trend toward eventual worthlessness, Bitcoin will become an increasingly popular choice for global savings to flee to. When a nation’s money is abandoned and replaced by Bitcoin, Bitcoin will have transitioned from being a store of value in that society to a generally accepted medium of exchange. Daniel Krawisz coined the term “hyperbitcoinization” to describe this process.

Part 4…

Part 4 of this article will be published tomorrow and linked from Twitter (follow me). In part 4, I will tackle some of the major arguments against Bitcoin and why they are incorrect when understood in terms of the economic framework that has been discussed in parts 1, 2 and 3 of this article. I will also consider some of the genuine risks that face Bitcoin on its path toward full monetization.

Go back to part 2.